CIS Enterprise Edition

- Pegasus CIS 5 - New Technology, New Look, New Functionality

- Summary

- Features

- Reverse Charge VAT

- Subcontractor Edition

Pegasus CIS 5 lets you see the profitability of the contract and the calculated costs to completion.

Pegasus CIS 5 is a software solution specifically designed for the construction and contracting industries. Pegasus CIS 5 helps give you complete control of your contracts: you will deliver projects on time and within budget to simultaneously transform your profitability.

>>> See it in action CIS 5 Brochure

>>> See it in action Watch the pre-recorded Pegasus CIS webinar.

>>> See it in action Watch a short CIS overview demo.

>>> See it in action View the CIS testimonial from one of our customers.

We are pleased to announce the release of Pegasus' new Construction Contract Costing solution - Pegasus CIS 5. It has been specifically designed to cater for the requirements of small to medium sized contractors and for those businesses that need a contract costing application. Pegasus CIS 5 is a brand-new product and is based on the existing Pegasus Construction Industry Solutions product – Pegasus CIS. Built with modern development technologies it delivers numerous new improved features and benefits over its predecessor, Pegasus CIS. It integrates with Opera 3 SQL and VFP Financials and Payroll applications as well as Sage 50 and 200.

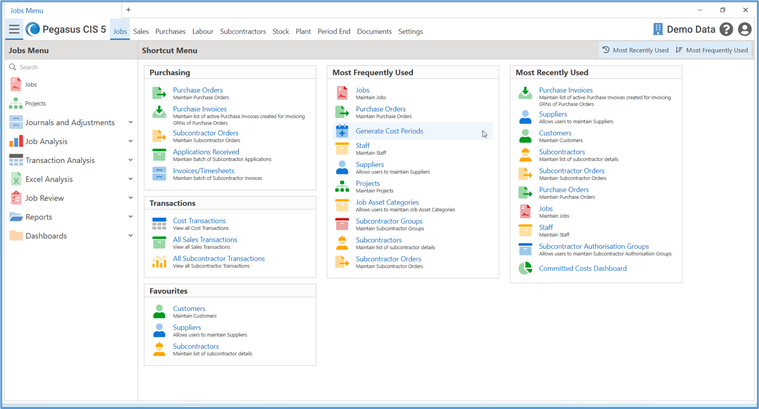

New Interface and User Experience

Pegasus CIS 5 has a totally new user interface and delivers a unique user experience

by providing:

• On-screen retrieval capabilities.

• Customisable Screen layouts per users with drag and drop technology.

• Powerful and easy to use worksheet creation.

• One-click integration with Microsoft Word and Excel.

• Multiple Tabs so people can work in different modules all at the same time.

• Multiple Tabs are available on the forms such as Customers, Suppliers and Subcontractors so that users can display multiple types of information such as the base information, transactions, and documents, etc.

• Pre-defined dashboards

Powerful Reporting Capabilities

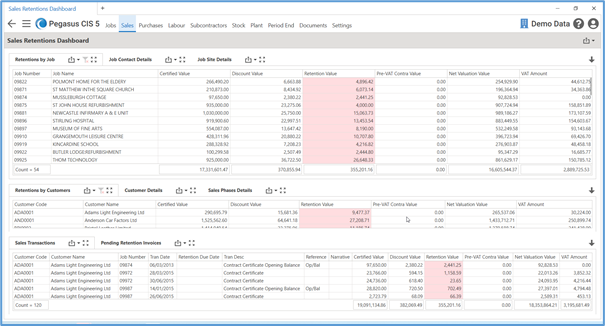

New reporting capabilities takes your reporting to the next level, giving you real-time information on all your projects to help make faster and smarter decisions. With Pegasus CIS 5 you will get integrated Crystal Reports©, on-screen reporting, integrated dashboards and Microsoft Excel© integration.

COMING SOON - Dashboard Designed which will allow you to edit existing Dashboards to suit your project requirements

Sales & Aged Debtors Dashboard

Personalised Subcontractors Dashboard

CIS 5 also includes 100 new enhancements. For all the information please download the brochures below:

When you consider that the average construction project suffers 150% cost overruns and completes more than 175% late, there’s clearly a great need for software that can help you to deliver projects on time and within budget.

Keeping you on the level

Pegasus CIS provides complete control over all aspects of contracts management, from costing and timesheets through to payment applications, VAT invoicing and cash receipt matching. Fully integrated to the Sales, Purchase and Nominal Ledgers, Cashbook and Payroll, Pegasus CIS conforms to the requirements and regulations of HMRC's Construction Industry Scheme.

Pegasus CIS recognises the complex business requirements of the construction sector, offering an unparalleled level of management control over contracts and subcontractors. It integrates with Opera 3, Opera II, Sage 50 and Sage 200.

Visit http://www.hmrc.gov.uk/new-cis/ for HMRC information relating to the Construction Industry Scheme, including frequently asked questions.

Taking control of contracts and costs

It has been estimated that the average construction project suffers 150% cost overruns and completes more than 175% late*. Investing in the right software could help transform this into a more profitable proposition where projects are delivered on time and within budget.

Simplifying administration and improving the cost controls on contracts

Controlling the costs of a project can be a daunting task. Not only does a company need to track the costs of purchases, there may be sub-contractors who need to be paid under HMRC's Construction Industry Scheme regulations, as well as raising and chasing Payment Applications to clients. Has a Payment Application been certified? How much is the Main Contractor Discount? When is the Retention due for payment? How much profit did you make on that job? These are the typical questions asked, but getting the answers quickly can be a problem when running a construction project.

Effective cash management is key to making a profit in a contracting environment. Pegasus CIS has been specifically designed to give instant access to up-to-date information that allows you to manage your contracts. Knowing what is owed and when it is due and who needs to be paid and when, are critical issues. Pegasus CIS addresses these and many others as part of helping you manage your contracts effectively.

Pegasus CIS: a closer look Contract costing software for the construction industry

Pegasus CIS is a contract costing system that has been specifically written for small to medium-sized (SME) contractors in the construction and allied industries. It eases the administrative burden of running construction projects, whilst providing all the management tools necessary to ensure that all critical information is readily available to the management team.

The system allows direct costs to be input against a contract, as well as costs derived from labour timesheets, purchases, stock and sub-contractors. A wide range of analysis reports are available, offering views of the current status of contracts, including job performance and detailed profit analysis reports.

Cost control is critical. Pegasus CIS captures all relevant contract information across all stages of a job so that the status of the contract is immediately available.

Contract Sales Ledger

Pegasus CIS includes a self-contained Contract Sales Ledger that works in conjunction with the accounts Sales Ledger. The Contract Sales Ledger maintains details of the current Payment Applications, together with all previous Applications; it also contains information on current and cumulative revenue values together with retention, main contractor discount, contras etc.

Payment Applications can be printed and certified, payments can be recorded, invoices generated and retentions tracked. When the payment is received it can be entered in batches and allocated to one or more Applications. For Applications, VAT is taken into account at time of payment. It is also possible to create standard invoices, where the VAT is recorded at the date of invoice.

Knowing when payments are due is critical to successful management of cash flow within any organisation. Pegasus CIS comes with comprehensive aged debt reporting features to allow these payments to be monitored.

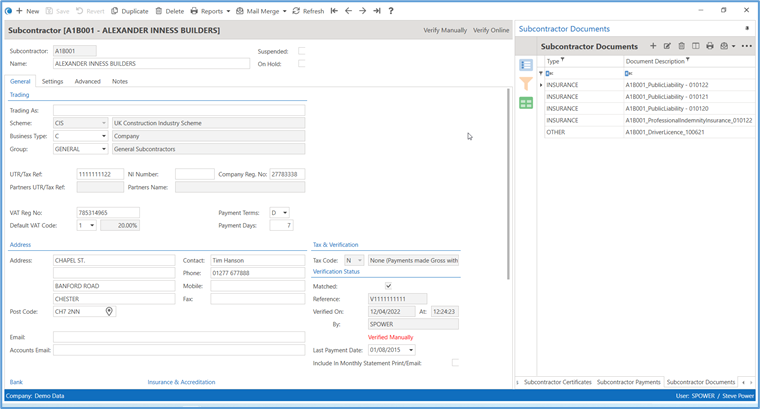

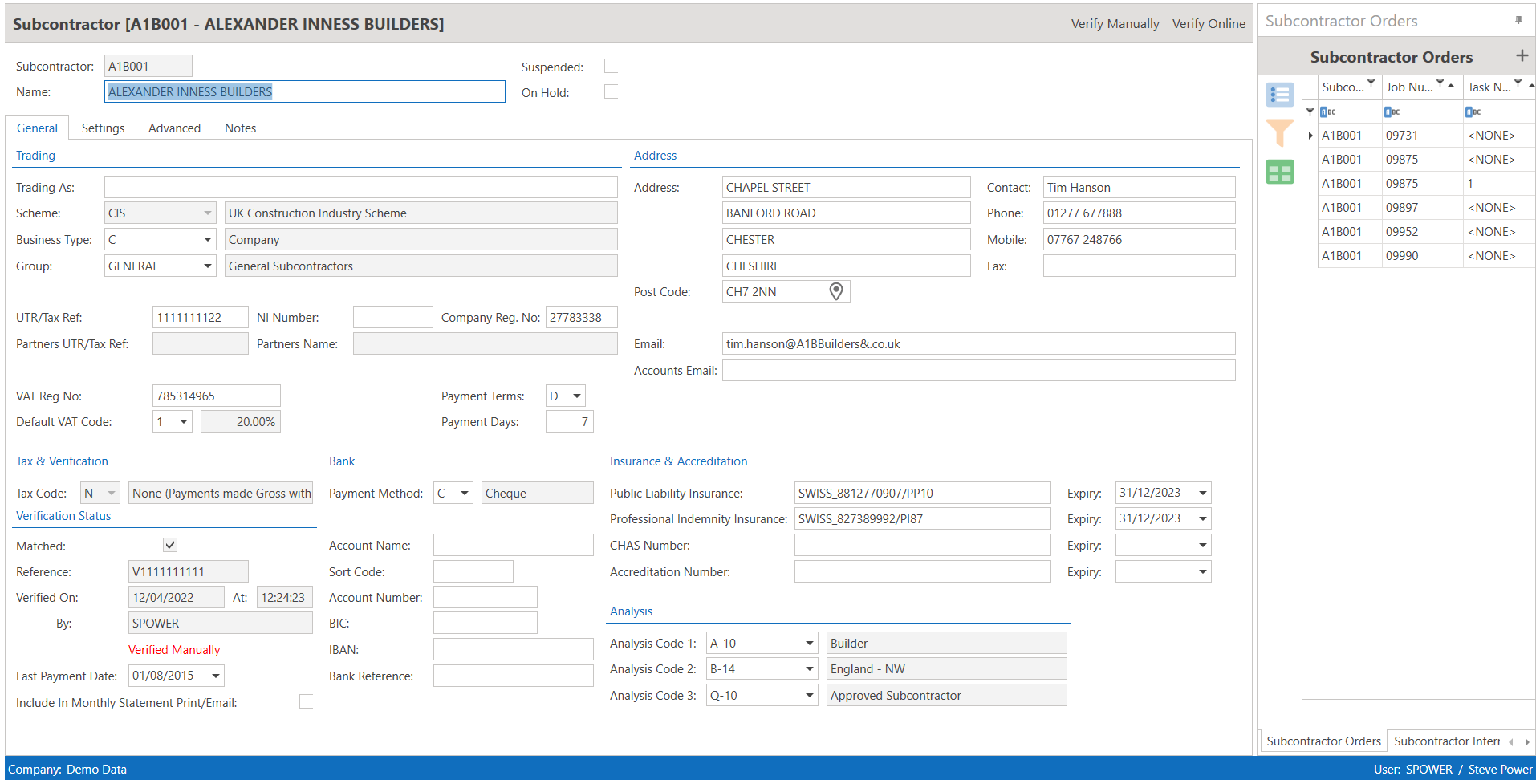

Subcontractors Ledger

Pegasus CIS includes a Subcontractors Ledger that combines the functionality of a Purchase Ledger with the regulatory requirements of HMRC's Construction Industry Scheme. With Pegasus CIS you can verify new subcontractors both manually and online. Once verified, the system knows whether the subcontractor is paid gross or net, and if net then to deduct tax at either the lower or upper rate. Pegasus CIS also allows you to produce the CIS 300 monthly report and to submit this manually or online.

Subcontractor Applications for Payment can be entered, detailing both current and cumulative values of net, gross, discounts and retentions for the specified contract. When a Subcontractor Application for Payment is approved, it is possible to produce a Payment Certificate that can be sent to the subcontractor with the payment. There is also a separate posting routine for timesheet only subcontractors.

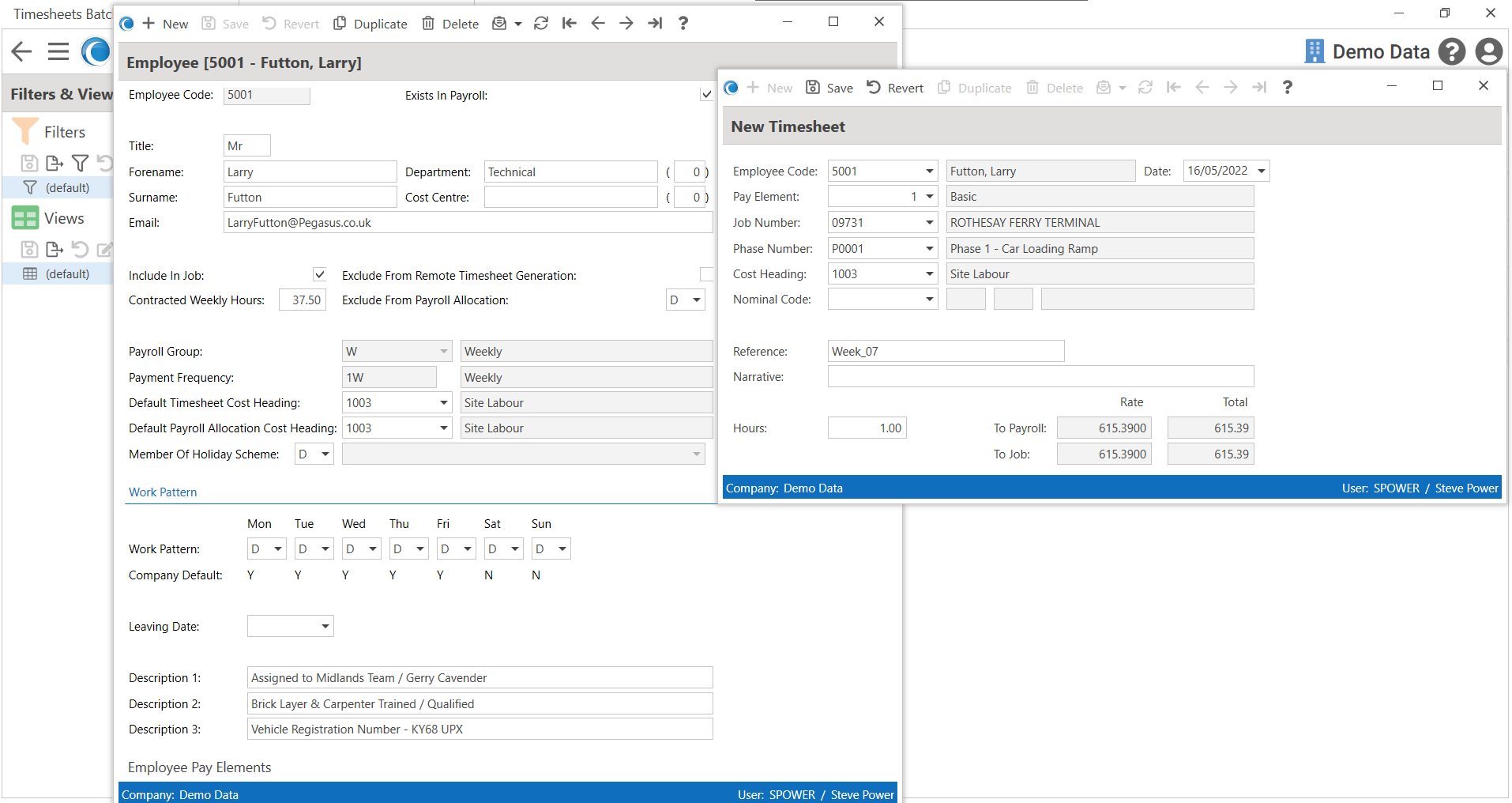

Labour costs

It is possible to enter employee timesheets directly into Pegasus CIS, post these costs to the contract and post these timesheets into the Payroll so that payslips are produced. The timesheet data-entry routines are fully optimised for fast entry of data, ideal for companies that need to process large data volumes. For companies that prefer to enter timesheets in the Payroll, it is possible to export them out of the Payroll and post them into Pegasus CIS.

Once the Payroll has been run it is possible to post the 'on-costs' into Pegasus CIS. This means that additional costs such as National Insurance, Pensions, CITB Levies etc can be posted back into the contracts. It is therefore possible to post labour to a contract as a charge-out rate, or as net or gross costs.

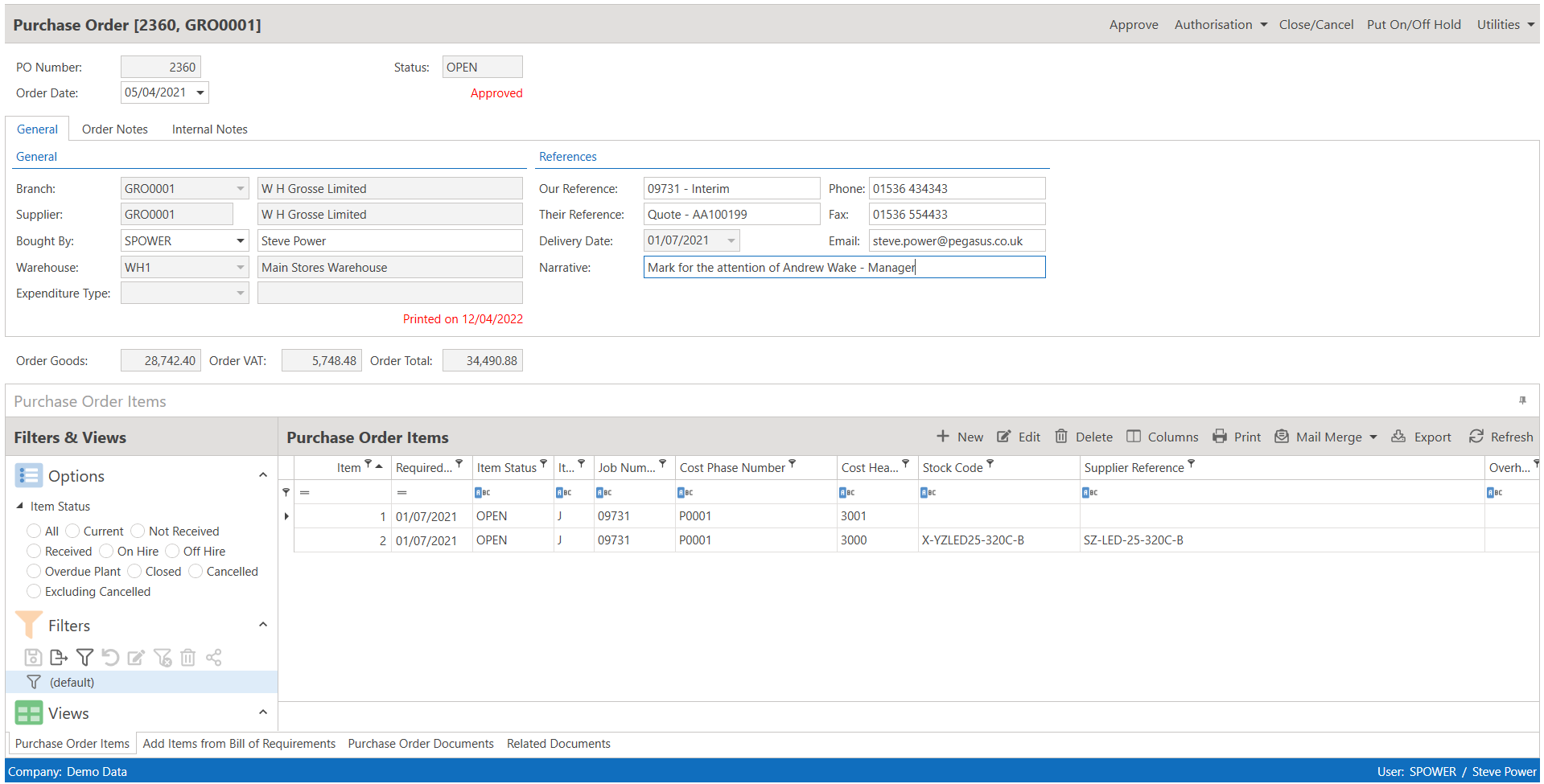

Contract purchasing

Pegasus CIS includes a Purchase Order Processing system that allows committed costs of a contract to be monitored by raising purchase orders against that contract. As deliveries are received and invoiced the purchase order is updated, maintaining an accurate picture of the committed costs. It is possible to arrange for deliveries to be made directly to site, knowing what is still to be delivered; all of which contributes to better site management.

The system is flexible, so that it's possible to turn off the Goods Received Notes section and simply raise purchase orders and match to the incoming purchase invoices. Purchase invoices that do not need to be directly related to a contract can be allocated directly to a nominal account.

The purchasing fully supports multi-currency, allowing you to raise purchase orders in currency and receive currency purchase invoices.

Procurement control

This is used to co-ordinate the purchasing of goods across the entire company, potentially against multiple Jobs and multiple Suppliers. Goods purchased using Procurement Control will be assigned to one or more Purchase Orders depending on the options selected.

This is intended to be used to process large volume orders quickly for delivery to a Job Site Address, Phase Site Address or Warehouse Address. If the Procurement is raised against a Bill of Requirements, this allows buyers to review the entire list of Job requirements and tag items (in full or partially) to be bought. This provides a rapid Job purchasing routine for buyers.

Plant hire

Purchase Orders can be raised for Hire of Plant supplied by external suppliers. Plant can be ordered against Jobs, which posts committed costs to that Job. It is possible to record "On Hire" and "Off Hire" dates so that plant does not remain on site unless required.Impressive functionality

Pegasus CIS is an application that covers all the requirements of contract costing: handling all the revenue and costs associated with running a contract, controlling materials, purchase orders and purchase invoices, through to the regulatory requirements of HMRC's Construction Industry Scheme. Fully integrated into the accounts system and payroll, Pegasus CIS truly transforms a company's ability to profitably manage contracts.

Powerful reporting

Pegasus CIS also integrates with award-winning Pegasus XRL, an intuitive tool that allows Microsoft Excel access to live data at the click of a mouse. It seamlessly integrates your financial information into Microsoft Excel in a couple of simple steps, so you don’t have to copy and paste, re-key or work out formulas.

The MIS features in Pegasus CIS also include export features to Microsoft Excel, providing powerful and adaptable access to the information held within both Pegasus CIS and the accounts system. This means Pegasus CIS delivers fast and accurate information and enhanced analytical power, which assists and simplifies even the most complex decision-making process. Purpose-built functions allow dynamic access to data in the Pegasus CIS system to populate Excel worksheets.

Sophisticated and flexible analysis

The Management Information System (MIS) features of Pegasus CIS easily adapt to the analytical requirements of a business. They make it easy to analyse key information, such as costs or revenues, by Contract, Project, Analysis Codes, Cost Head etc. Budgets and estimated costs can be specified at Cost Head level while the system will maintain the Opening, Actual, WIP, Committed, Other Costs and calculated costs to completion. The financial position is always available and can be analysed and interrogated using the highly configurable and user definable dynamic View screens.

Linking Pegasus CIS to your accounting solution

The following diagram details the main data flow between Pegasus CIS and Opera 3. It is also possible to integrate Pegasus CIS into Opera II, Sage 50 and Sage 200 accounting systems.

Nominal Ledger integration

Pegasus CIS fully integrates with the accounts system; the prime requirement is to eliminate double posting of transactions so that no manual posting is required. All transactions posted to the Nominal Ledger are stored in an audit file for analysis and reporting.

Purchase invoices entered into Pegasus CIS are posted to the contract and to the accounts Purchase Ledger, handling both the Nominal Ledger and VAT allocations. Similarly, sales invoices produced within the Contract Sales Ledger are posted to the account Sales Ledger. Other transactions posted to a contract, including timesheets, will raise an entry in the Nominal Ledger. A transaction posted into Pegasus CIS that has an effect on the P&L, Balance Sheet, VAT account or Cashbook has a Nominal Ledger Journal created, using the default Nominal Ledger account codes which come with the system.

Stock Control

Integration between Stock Control and Contract Purchasing allows stock to be ordered from suppliers against contracts. Stock can be Allocated, Reserved and Issued to a contract, posting relevant costs to the contract. When allocating stock to a contract it is possible to nominate the period in which that allocation is required. This is extremely useful where there is a requirement to plan stock issues to a contract based on when it will be required.

Stock can hold up to three dimensions (such as length, breadth, height) which can be used on the purchase order to calculate and allow ordering in, for example, square metres. The stock system is multi-warehouse and multi-location, so it is possible to look at all stock in a warehouse or at a site.

Monitoring stock levels, knowing where stock is located and knowing what needs to be ordered and when, are all elements managed within the Pegasus CIS Stock Control module.

Site Requisition

This option tracks requests coming in from site and allows available stock to be issued to the Job with an accompanying delivery note.

Site Requisitions have an added advantage over standard Stock Issues in that stock can be issued from multiple locations for the one Job. These Site Requisitions can be entered, picked and approved. Once approved, they can be used to post the related stock issues and generate the Delivery Note for passing to the issuing stores. This provides a powerful yet controlled method of allowing stock to be requested from the site office.Reverse Charge VAT

>> Read the datasheet here

Sales:

Reverse Charge VAT is a major change to the way VAT is collected in the building and construction industry and comes into effect on 1 March 2021. To reflect this, Pegasus CIS v4.10 has been fully updated to handle the processing of domestic Reverse Charge VAT. This will require both Pegasus CIS and your back-office accounts system to be set up accordingly.

In addition to this, the Sales Invoice and Contract Certificate Invoice report layouts will need to be updated to be in accordance with the new legislation so that they meet the legal requirements. The standard layouts have all been updated to reflect these new requirements.

Reverse Charge VAT is applied to invoices based on the settings picked up from the VAT Codes table, ie VAT Codes need to be specifically set up to handle Reverse Charge VAT. The actual figures posted to the VAT Return when Reverse Charge VAT is applied are as follows:

- The VAT that a customer is due to pay on behalf of a subcontractor is calculated on all Sales Invoices, Contract Internal Valuations, Contract Applications and Contract Cdertificates so it can be displayed on invoice layouts, but the VAT value is not added to the invoice total.

- These VAT values are essentially only notional figures and ultimately a zero-rated invoice is posted into the Sales Ledger. This will therefore only end up affecting Box 6 (Value of Sales) on the VAT return.

Purchasing and Subcontractors:- The VAT that the company (acting as the Customer) is due to pay on behalf of their suppliers/subcontractors is calculated on all Purchase Invoices, Subcontractor Internal Valuations, Subcontractor Applications, Subcontractor Certificates, Subcontractor Invoices and Subcontractor Payments (in the case of Deferred VAT on Subcontractor Certificates), but the VAT value is not added to the invoice total as it is not due to be paid to the Supplier/Subcontractor.

- When these transactions are posted into the back-office accounts system (via the Purchase Ledger for Purchase Invoices or as Nominal Journals for Subcontractor transactions), in addition to the usual postings affecting Box 4 (VAT on Purchases) & Box 7 (Value of Purchases) on the VAT Return, it also posts the VAT value to Box 1 (VAT on Sales).

These changes will be available in Pegasus CIS v4.10. Opera 3 must be on v2.61.01 or above. To read more about Reverse Charge VAT and CIS v4.10, read the datasheet here. If you want to discuss your Opera 3 or CIS installations to ensure you are on the correct version regarding this legislative change, contact your Account Manager or call us on 08000 195101Pegasus CIS Subcontractor Edition

Pegasus CIS Subcontractors focuses on controlling all aspects of subcontractor administration, enabling any company that operates under the HM Revenue & Customs Construction Industry Scheme to efficiently manage payments, tax and retention while covering all of the legislative requirements.

Pegasus CIS Subcontractors is an ideal solution for contractors who use subcontract labour on their Jobs and need to efficiently handle HM Revenue & Customs (HMRC) legislation that governs the use of these subcontractors. Pegasus CIS Subcontractors controls all aspects of subcontractor administration from subcontractor verification, invoice / timesheet / application entry and payment, through to generation of the figures required on monthly returns to HMRC & submission of these via the online services.

What’s the difference between Pegasus CIS Subcontractors and the full Pegasus CIS Enterprise solution?

While Pegasus CIS Subcontractors manages the subcontractor element of contracts, Pegasus CIS Enterprise is a fully integrated Contract Costing system that manages all of the financial aspects of running a contract. In addition to the features offered by Pegasus CIS Subcontractors, Pegasus CIS Enterprise also allows the entry of costs from suppliers, direct labour, stock and other areas such as petty cash, together with sales revenue from both Invoices and Applications/ Certifications.