< Return to Opera Homepage

Manage customer debt effectively to improve cashflow

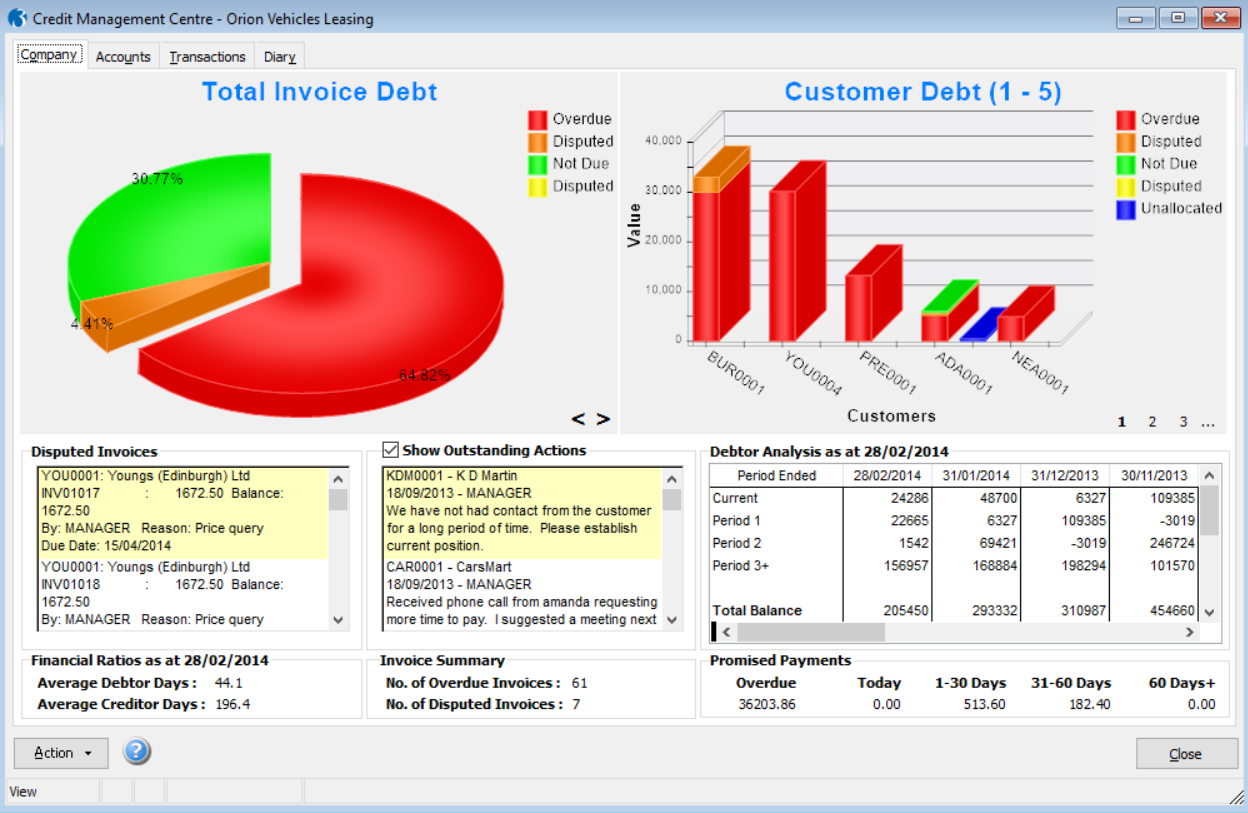

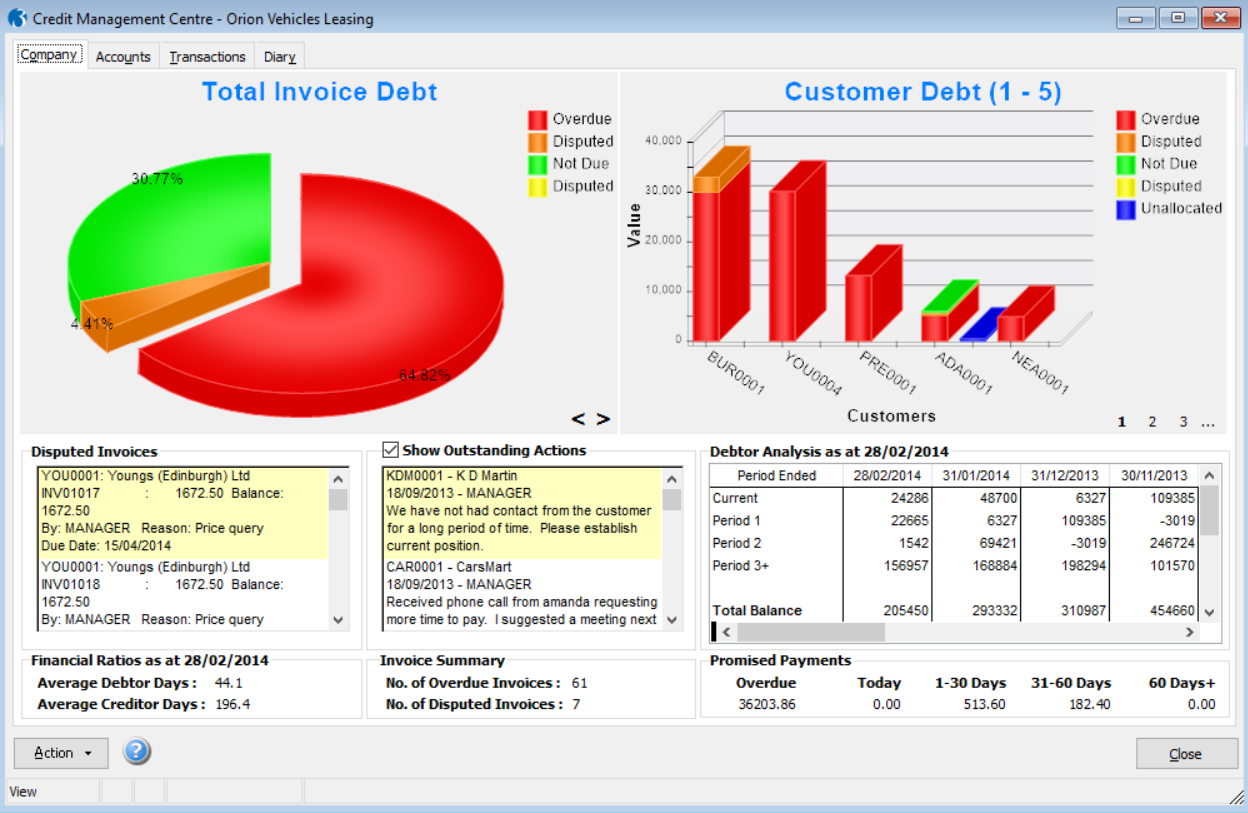

The Credit Management Centre provides credit controllers and those involved in debt management with a centralised, easy-to-use tool which consolidates all of the information needed for effective credit control. Easy-to-understand, real-time graphs display your overall financial status so you can quickly see what is owed, who owes it and how much money has been promised by customers. This gives you all the information you need to improve cashflow, reduce bad debt and improve the overall financial position of your business.

The Debt Management feature in the Credit Management Centre lets you create up to nine levels of debtor correspondence, such as debt recovery letter templates, to chase late payments. At least 60% of SMEs experience late customer payments and if you’re one of them, the Debt Management function will help you get paid faster and get your cashflow back on track.

Diary Actions report: Lists the diary actions that have been recorded, and can be exported to Excel. You can select to include actions for today only, from the last 7 days, from the last 30 days or for a range of dates. You can also include completed actions, notes added for actions, and actions that have been marked for follow-up.

Promised Payments report: Lists the values of payments that have been promised to you by your customers, and can be exported to Excel. Promised payments and dates are recorded on diary actions. You can sequence the report by: account (grouped by the user or the value), user (grouped by the customer account or the value), value, balance and promised date.

Action Types report: An analysis of the Diary Actions that have been entered. Separate totals are displayed for each action, outstanding actions, overdue actions and completed actions.

Credit Management Groups report: Displays the total outstanding debt for each group.

Outcome Types report: Lists an analysis of the Outcome Types for diary actions that have been entered. Separate totals are displayed for all Outcome Types, outstanding actions, overdue actions and completed actions grouped by Outcome Type.

- Easy-to-understand dashboard views of the overall financial position of your company and customers

- Drill down behind key financial information, customer accounts, and transactions

- Powerful filters allow you to manage customers that are over their credit limit and/or have overdue invoices

- Create and organise customers into Credit Management Groups according to their Debt

- Define custom Action Types and Outcome Types to be used with diary actions for recording activities and follow ups

- Create and amend diary actions against individual customers or transactions, with an optional follow-up reminder via Notification Services

- Record and revise Promised Payments against individual transactions or at account level

- Integrates with the Opera 3 Sales Ledger with instant access to the Account view for historical information

- Easily put accounts on or off Stop, increase or decrease credit limits, and re-organise accounts into different Credit Management Groups individually or in bulk

- Dispute invoices and record the appropriate reason code

- Print Statements, Copy Invoices and produce debtors letters

- Keep on top of actions due for completion with the Diary view

- Additional Credit Management reports including: Promised Payments & Diary Activities that can also be exported directly to Excel

- Integrates with Pegasus Instant Messenger (PIM) and Pegasus XRL