Pegasus Data Connector

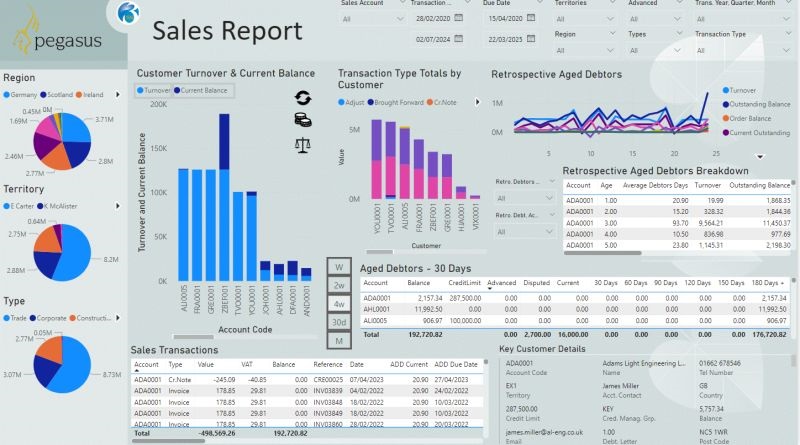

Imagine being able to access data from any part of your financial and business solution and then present that data in a form that can be easily digested and distributed around the company to non-financial users. The new Data Connector for Opera 3 SE lets you do exactly that.

Better still this information can be interrogated using latest AI tools for further decision making and even alerting you when limits have been exceeded for areas such as credit limits, below stock values and more.

How does it work?

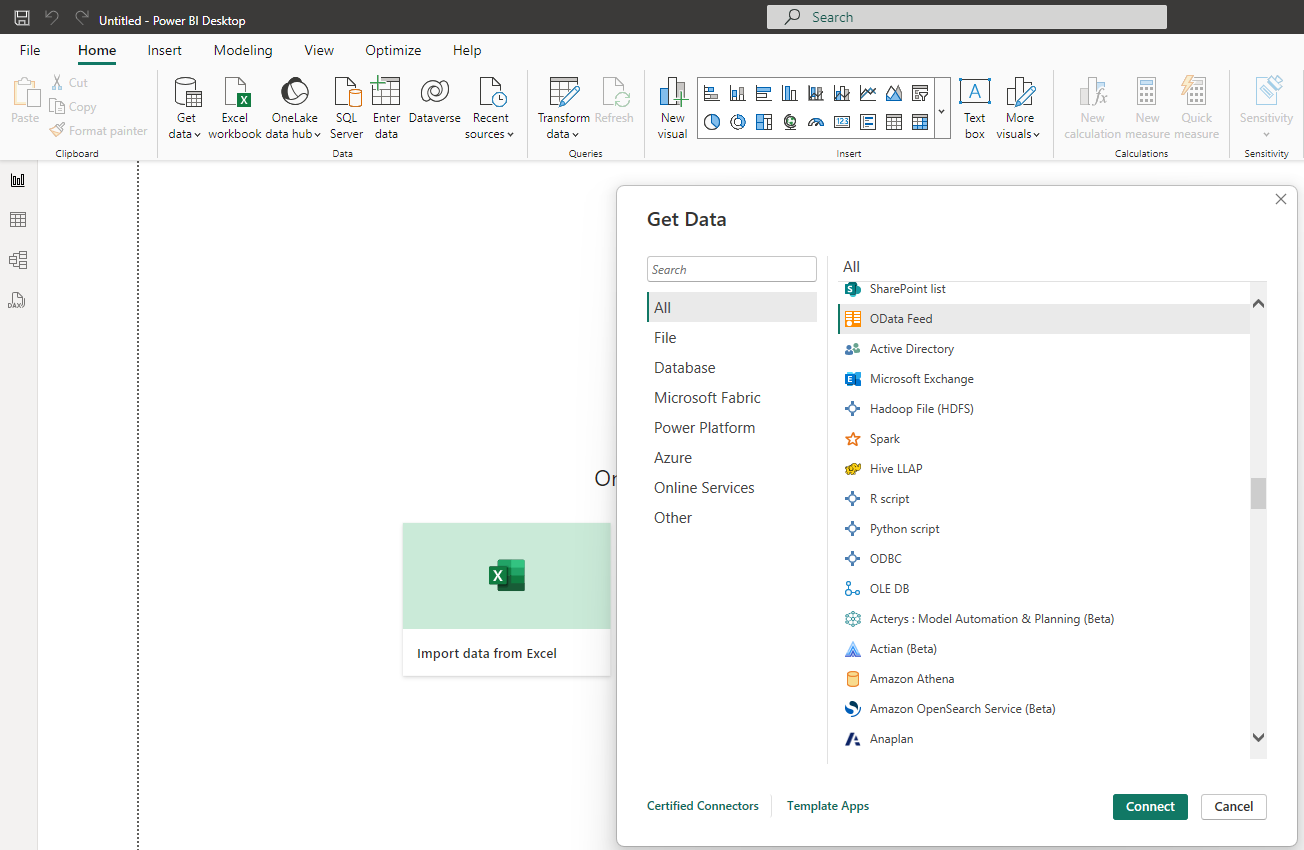

The Opera 3 SE Data Connector uses fast and modern technology to access data in Opera 3 SE with flexible querying, based on OData, to access and extract information in an efficient and effective manner.

What Can it be used for?

With the power of simple, secure data extraction at your fingertips, all data within SQL SE, including any data held within added bespoke development can be analysed and reported on. Whether it is direct into Microsoft Excel or used to create Power BI Dashboards or to create business critical alerts, the Data Connector is the solution. Artificial Intelligence tools can also be used on the data to assist with answering those pressing questions for business to grow and succeed in ever more competitive markets.

Data Connector features and benefits include:

- Data Access Made Easy: The Data Connector uses modern technology to swiftly access your data and business information.

- User-Friendly Querying: With flexible querying based on OData, you can retrieve information effectively with straightforward, user-friendly access.

- Collaboration: Share insights with your team effortlessly. Whether it’s financial data, inventory details, or customer trends, the Data Connector ensures everyone can be informed.

- Integration: Connects seamlessly with other well-known business tools such as Microsoft Power BI and Excel.

- Greater Insight: The Data Connector enables you to drill down into your data to analyse anything from sales trends, stock levels, or tracking credit limits.

- Custom Dashboards: create dynamic dashboards in Power BI that visualise your business KPIs to provide real-time insights.

- Automated Alerts: Set up alerts for critical thresholds. Whether it’s low stock levels, exceeded credit limits, or overdue invoices, the Data Connector can notify you instantly.

- AI-Driven Decision Making: Leverage artificial intelligence tools to answer pressing questions. Use it to predict future sales based on historical data.

- Efficient Reporting: Export data directly into Microsoft Excel for detailed analysis. Create custom reports tailored to your business needs.

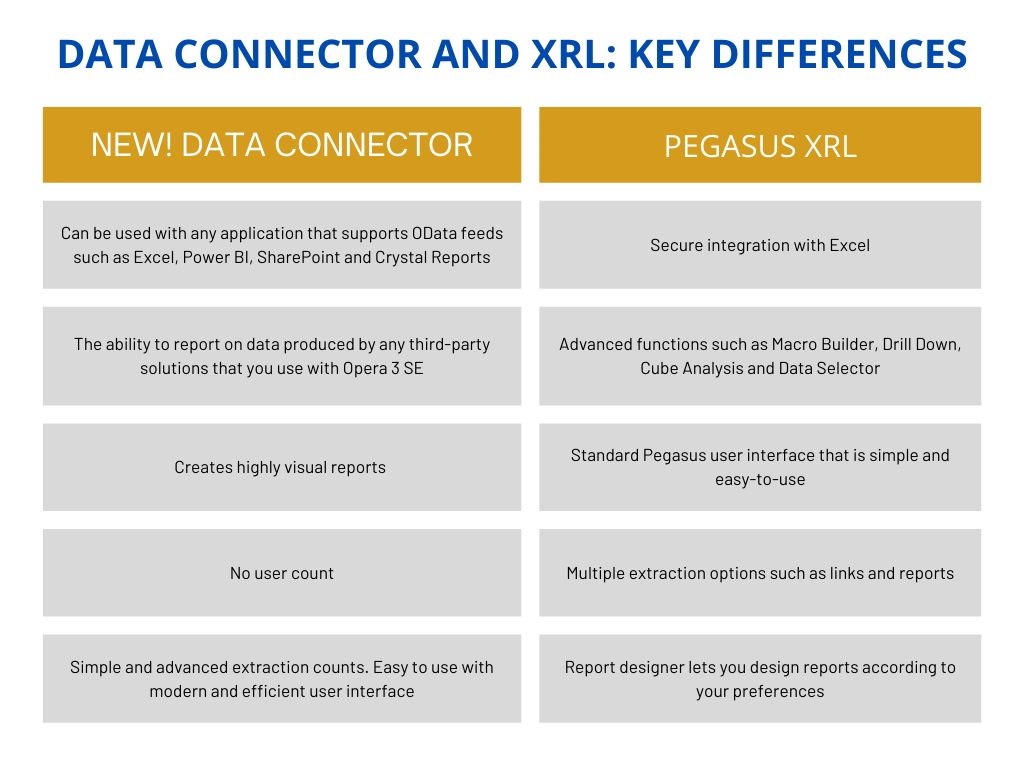

What's the difference between the Data Connector and XRL?